Sotheby’s Receives $1 Billion Investment from Abu Dhabi Investment Fund

This Move Asserts the Strategy for the Brand’s Middle Eastern Growth

Abu Dhabi has made an immense contribution to the growth of the arts and culture sector in the UAE, the first phase of which was the opening of the Louvre Abu Dhabi in 2017. Since then, the emirate has earned the title of the nation’s culture capital owing to its continual investment in the arts.

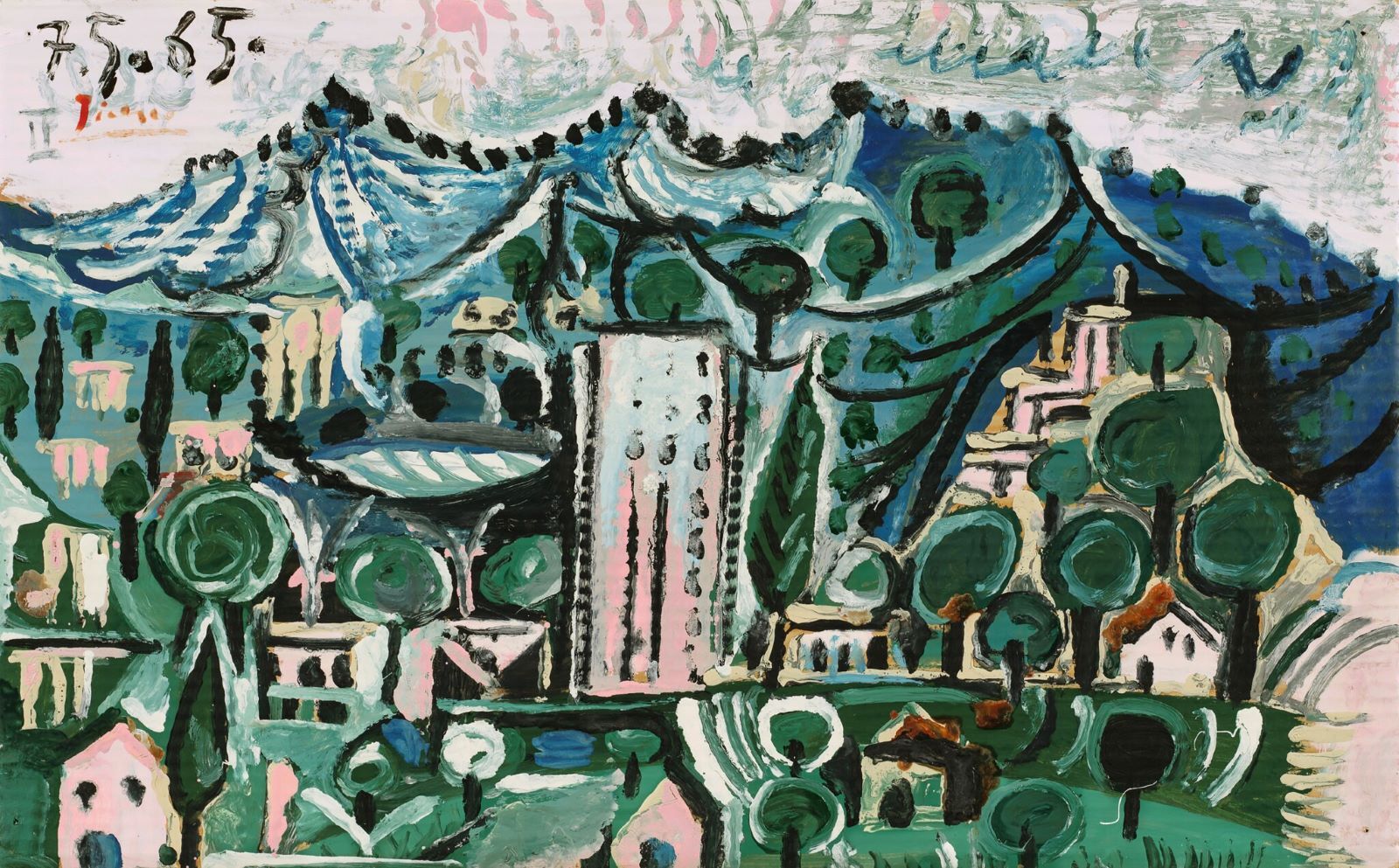

In early August of this year, Abu Dhabi acquired a minority stake in Sotheby’s auction house, a world-renowned purveyor of luxury goods such as fine art and jewellery since 1744. First founded in the UK with its current headquarters in New York, Sotheby’s has been building a steady presence in the Middle East, which will be further bolstered by the addition of a notable minority stakeholder from the region.

A total sum of $1 billion has been invested into the company, the majority of which was provided by the emirate’s third largest state investment fund ADQ. The remaining capital comes from Patrick Dahi, the owner of Sotheby’s and a majority shareholder since he acquired the Sotheby’s brand in 2019.

A Vision for Regional Expansion

Through this investment, Sotheby’s has set its sights on further growth within the Middle East region, which has become a lucrative market for high-net-worth buyers. Charles F. Stewart, CEO of Sotheby’s, has expressed that the auction house is ‘delighted’ by the addition of ADQ as a minority stakeholder and the prospect of regional growth for the Sotheby’s brand.

Stewart further commented: "The additional capital and investment expertise will enable us to accelerate our strategic initiatives, expand our commitment to excellence in the art and luxury markets, and continue to innovate to better serve our clients around the world.”

This transaction is expected to be completed by the end of the year.

The affiliation of Sotheby’s and the emirate of Abu Dhabi fits neatly into the strategic goals of ADQ, which aims to steer the economy of the UAE past oil towards a knowledge academy. To that end, ADQ has also invested significantly in healthcare, life sciences and energy, focusing on the long-term value provided for its growth strategy.

How does this impact Saudi Arabia Sotheby’s International Realty?

The magnitude of this investment underlines the high levels of trust that a brand with the pedigree of Sotheby’s continues to earn from around the world.

According to Hamad Al Hammadi, ADQ deputy group CEO: “We are thrilled to partner with Sotheby’s, a prestigious institution with a rich history. ADQ is committed to pursuing compelling investments that add value to Abu Dhabi. This investment demonstrates our confidence in Sotheby’s brand, its leading market position, and the capability of its management team to drive growth.”

He went on to add: “We look forward to exploring new collaboration opportunities with Sotheby’s and supporting its journey forward.”

The regional expansion of the auction house presents Saudi Arabia Sotheby’s International Realty with new growth and partnership opportunities, allowing it to present high-net-worth clients with a greater range of options to expand their regional investment portfolios. There is a strong link between the fine art and real estate sectors, and the investor profiles for both are quite similar.

This partnership is of particular benefit to Saudi Arabia Sotheby’s International Realty, providing further avenues to showcase prime real estate options to investors and collectors as the brand continues to strengthen its presence in the growing luxury sector of the region.

Once the deal has been completed, Sotheby’s and the emirate of Abu Dhabi will be jointly poised to play a key part in driving the future of the fine art and luxury markets, in the Middle East and on a global scale.